- #USING OFFSET TO MOVE CASHFLOWS HOW TO#

- #USING OFFSET TO MOVE CASHFLOWS FULL#

- #USING OFFSET TO MOVE CASHFLOWS SOFTWARE#

Assume Interest Income on average cash balances is 1%. Assume New Goodwill equals Purchase Equity Value less Book Value of Equity.

This fee will be amortized on a five-year, straight-line schedule. In addition, there is a financing syndication fee of 1% on all debt instruments used.Assume that the M&A fee cannot be expensed (amortized) by ABC and will be paid out of the sponsor equity contribution upon close. The M&A fee for the transaction is $1.5 million.Assume that LIBOR for 2012 is 3.00% and is expected to increase by 25bps each year.Assume that all cash beyond the minimum cash balance of $5 million and the required amortization of each tranche is swept by creditors in order of priority (i.e.

Assume that all remaining funding comes from the financial sponsor. Assume a minimum cash balance (Day 1 Cash) of $5 million (this needs to be funded by the financial sponsor as the transaction is a cash-free / debt-free deal). Existing management’s ownership pre-LBO is 10%. Assume that existing management expects to roll-over 50% of its pre-tax exit proceeds from the transaction. (Hint: add the PIK interest once you have a fully functioning model that balances.) Subordinated Debt: 1.5x 2011 EBITDA, 12% annual interest (8% cash, 4% PIK interest), 2017 maturity, $1 million required amortization per year. RCF is available to help fund operating cash requirements of the business (only as needed). Senior Revolving Credit Facility: 3.0x (2.0x funded at close) 2011 EBITDA, LIBOR + 400bps, 2017 maturity, commitment fee of 0.50% for any available revolver capacity. COGS assumptions (assume constant throughout the projection period): Note that ABC Company does not incur any additional costs for renewals. To simplify, assume that renewals happen for only one additional year and that the recurring revenue stream is based on the prior year’s new licenses. ABC Company renews approximately 25% of the licenses it sold in the prior year this renewal fee acts as a source of recurring revenue.

Assume that all remaining funding comes from the financial sponsor. Assume a minimum cash balance (Day 1 Cash) of $5 million (this needs to be funded by the financial sponsor as the transaction is a cash-free / debt-free deal). Existing management’s ownership pre-LBO is 10%. Assume that existing management expects to roll-over 50% of its pre-tax exit proceeds from the transaction. (Hint: add the PIK interest once you have a fully functioning model that balances.) Subordinated Debt: 1.5x 2011 EBITDA, 12% annual interest (8% cash, 4% PIK interest), 2017 maturity, $1 million required amortization per year. RCF is available to help fund operating cash requirements of the business (only as needed). Senior Revolving Credit Facility: 3.0x (2.0x funded at close) 2011 EBITDA, LIBOR + 400bps, 2017 maturity, commitment fee of 0.50% for any available revolver capacity. COGS assumptions (assume constant throughout the projection period): Note that ABC Company does not incur any additional costs for renewals. To simplify, assume that renewals happen for only one additional year and that the recurring revenue stream is based on the prior year’s new licenses. ABC Company renews approximately 25% of the licenses it sold in the prior year this renewal fee acts as a source of recurring revenue. #USING OFFSET TO MOVE CASHFLOWS SOFTWARE#

That was the first year ABC Company generated any revenue.Įach software application requires the payment of a $5.00 renewal fee every year. ABC Company sold 1.5 million copies of Cloud and 3 million copies of Time in 2010. ABC Company prices Cloud at $16.00 and Time at $36.00 per software license. The second application, Time, acts as a calendar that keeps track of a user’s schedule. The first is a software application called Cloud that tracks weather data. The company sells two products for the various smartphones. is a developer of software applications for smartphone devices. Scenario Overview and Revenue Assumptions:ĪBC Company, Inc. Remember that candidates will receive a laptop and a printout with key information regarding the transaction to complete this assignment.ĪBC Company, Inc.

#USING OFFSET TO MOVE CASHFLOWS HOW TO#

We will use it as an example of how to build an LBO model from scratch during the interview. Given Information (Parameters and Assumptions)īelow we provide the given information from a real-life LBO test that was given to a pre-MBA associate candidate at a large PE firm.

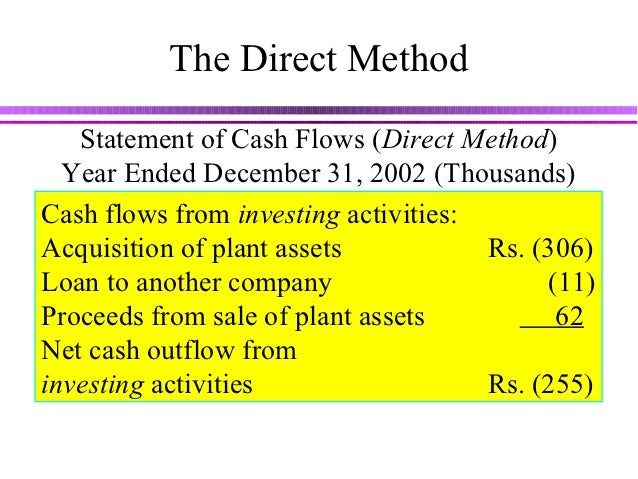

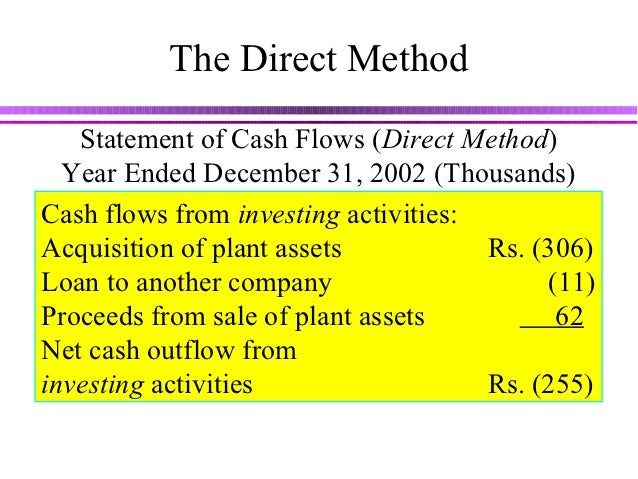

Step 6: Cash Flow Statement Projections. #USING OFFSET TO MOVE CASHFLOWS FULL#

Step 4: Full Income Statement Projections. Given Information (Parameters and Assumptions). In the following LBO Case Study module, we will cover the following key areas: Repeated practice, checking for errors and difficulties and learning how to correct them, all the while enhancing your understanding of how an LBO works, is the key to success. You must therefore begin practicing this technique in advance of meeting with headhunters. This type of LBO test will not be mastered in a day or even a week. There are many complex formulas in this test, so make sure you understand every calculation. Make sure to take your time and build every formula correctly, since this process is not a race. Therefore, you should strive to be able to do these studies effectively and efficiently without draining yourself so much that you can’t quickly rebound and move on to the next interview. In-office case studies and modeling tests can occur at various stages of an interview process, and additional interviews with other members of the private equity team could occur on the same day. In this module, we will walk through an example of an in-office LBO modeling test. When interviewing for a junior private equity position, a candidate must prepare for in-office modeling tests on potential private equity investment opportunities-especially LBO scenarios.

0 kommentar(er)

0 kommentar(er)